Small Business Bookkeepers Scarborough

Small Business Bookkeeping Services Scarborough and Legal Bookkeeping for Lawyers, Professionals, Trades, and eCommerce Businesses. Scarborough Bookkeepers That Keep You Business Focused and CRA-Compliant

Scarborough is home to a diverse community of professionals, tradespeople, health clinics, and service-based entrepreneurs. Whether you’re a self-employed plumber in Malvern, a pharmacist in Agincourt, or a law firm in Eglinton, accurate bookkeeping is the foundation of your business’s stability. And, our online bookkeepers ensure this with reliable bookkeeping and accounting services in Scarborough.

At MAQ CPA accounting firm, our small business bookkeepers provide cloud bookkeeping services in Scarborough that take the stress out of managing your finances. We don’t just plug in numbers—we help you stay organized, make smarter decisions, and meet all CRA obligations without headaches.

With real CPAs, cloud-based tools, and personalized service, we support clients across industries with year-round bookkeeping, payroll, GST/HST filing, and strategic insights to help you grow.

Tailored Remote Bookkeeping for Scarborough’s Most Active Business Sectors

Scarborough Small Business Owners

From family-run takeout restaurants to solo tradespeople and online retailers, Scarborough’s small businesses are diverse—and so are their bookkeeping needs. Without up-to-date records, it’s easy to lose track of cash flow, miss deductions, or file taxes late.

Our QuickBooks Accountants or Xero Bookkeepers support Scarborough small businesses with monthly bookkeeping, payroll processing, HST returns, and custom reports that help you plan with confidence and stay in control.

FAQs – Small Businesses Scarborough

1. What’s the best accounting software for a Scarborough small business?

We recommend QuickBooks Online or Xero. We can help set it up and train you if needed.

2. How do I know if I need to register for HST?

If your business earns $30,000+ in gross revenue in a single quarter or over four consecutive quarters, registration is mandatory.

3. Can I claim business use of my home?

Yes—if you have a dedicated workspace, you can deduct a portion of your utilities, rent/mortgage interest, and internet.

4. What if I pay staff cash?

That can be risky. We help you set up proper payroll, issue T4s, and stay compliant with CRA and WSIB.

5. Will you also help with personal tax filing?

Yes—many of our clients are owner-operators and we file both corporate and personal returns.

Lawyers and Legal Firms in Scarborough

For legal professionals in Scarborough, Law Society of Ontario trust accounting rules must be followed precisely. Errors in trust account reporting, client ledgers, or reconciliations can lead to serious consequences.

We handle monthly trust reconciliations and general bookkeeping—so you can focus on your clients.

FAQs – Legal Professionals Scarborough

1. Can you manage both my trust and general accounts?

Yes—we can record transactions and reconcile both accounts monthly.

2. What if I’m behind on my trust reconciliations?

We offer trust cleanup and backdated reconciliations to bring you back in line with LSO rules.

3. Can you help me prepare for a Law Society audit?

Yes—we prepare all necessary ledgers, reports, and reconciliations, and walk you through the audit process.

4. How often should legal trust reconciliations be done?

Monthly—at a minimum by 25th of the following month. It’s required by the LSO, and we make sure it’s done right.

Healthcare Clinics & Medical Professionals in Scarborough

Scarborough’s medical sector is growing fast—from walk-in clinics to incorporated physicians and dentists. These businesses require clear tracking of OHIP income, staff wages, and deductible expenses—especially if operating through a Medical Professional Corporation (MPC).

We handle clinic bookkeeping, payroll, expense allocation, HST calculation on non-insured services, and capital asset tracking for equipment-heavy practices.

FAQs – Doctors and Medical Professionals Scarborough

1. Do I charge HST on medical services?

Most insured services are HST-exempt, but non-medical services (e.g., cosmetic procedures) may require HST collection.

2. How do I record OHIP income?

We match OHIP remittances to deposits and reconcile your statements monthly.

3. Should I pay myself a salary or dividend from my MPC?

It depends on your overall tax situation. We offer remuneration planning based on your goals and income.

4. Are scrubs, gloves, and office supplies tax deductible?

Yes—all necessary medical supplies are deductible if used in your practice.

5. Can you handle payroll for clinic staff?

Yes—we manage payroll, CRA remittances, and prepare year-end T4s and ROEs.

Chiropractors, Dentists, Optometrists, Pharmacies & Regulated Health Clinics Scarborough

Scarborough’s health practitioners face strict requirements when it comes to inventory, equipment depreciation, clinic leasehold improvements, and associate compensation. We deliver industry-specific bookkeeping that ensures compliance and financial clarity.

FAQs – Chiropractors, Dentists, Optometrists, Pharmacies Scarborough

1. How do I record equipment purchases like chairs or x-ray machines?

These are depreciated over time using CRA’s Capital Cost Allowance (CCA) system—we handle that for you.

2. What’s the best way to track product sales (e.g., supplements, eyewear)?

We separate taxable from exempt revenue, and monitor cost of goods sold where applicable.

3. Can I deduct rent and utilities for my clinic?

Yes—rent and utilities are fully tax deductible if used for business purposes.

4. What if I share space with other practitioners?

We help allocate expenses fairly across practitioners.

5. Will you provide statements for bank loans or lease approvals?

Absolutely—we prepare accountant-certified financial statements with a compilation engagement report.

Scarborough’s Trades, eCommerce, Startups, Auto Businesses & Franchises

We also serve the unique needs of Scarborough’s most active sectors including:

- Contractors & Construction: bookkeeping, equipment tracking, T5018s

- eCommerce: Shopify and Amazon integrations, multi-province HST compliance

- Auto Shops: recordkeeping, HST on vehicle sales

- Fitness & Wellness Studios: Class-based revenue, payroll, GST/HST tracking

- Franchises: bookkeeping and royalty recording

- Landscaping Services: revenue recording, subcontractor expenses, CRA filings

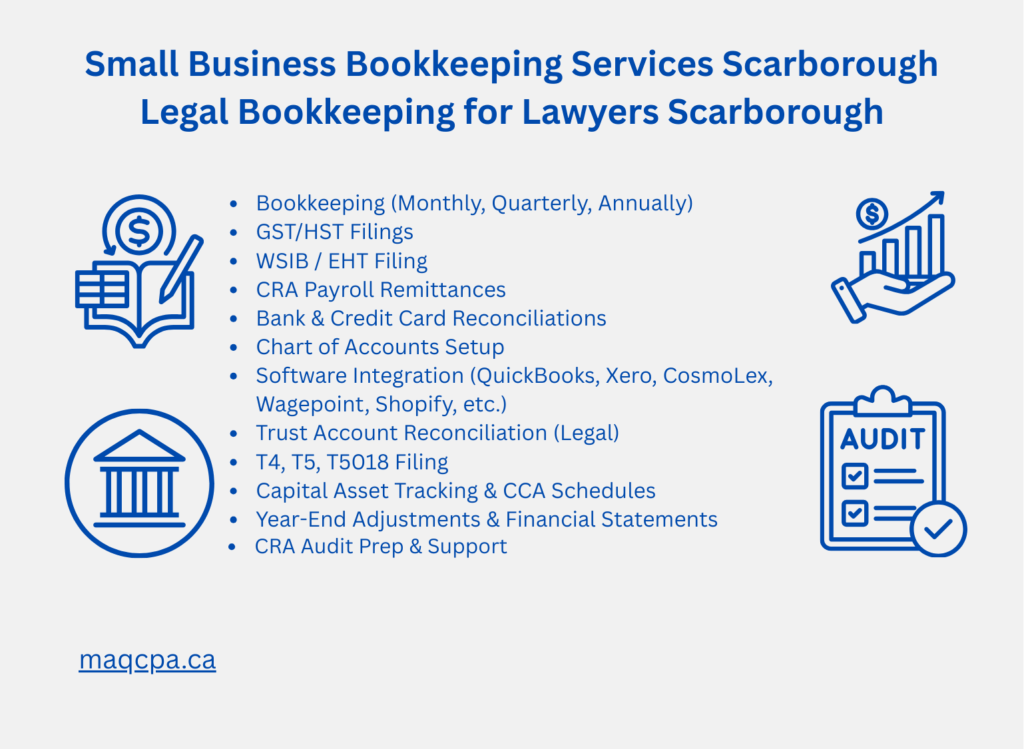

Comprehensive Service List – What We Offer

- Bookkeeping (Monthly, Quarterly, Annually)

- GST/HST Filings

- WSIB / EHT Filing

- CRA Payroll Remittances

- Bank & Credit Card Reconciliations

- Chart of Accounts Setup

- Software Integration (QuickBooks, Xero, CosmoLex, Wagepoint, Shopify, etc.)

- Trust Account Reconciliation (Legal)

- T4, T5, T5018 Filing

- Capital Asset Tracking & CCA Schedules

- Year-End Adjustments & Financial Statements

- CRA Audit Prep & Support

CRA Compliance – Always a Priority

Our team ensures you’re following all Canada Revenue Agency (CRA) rules and filing requirements, so your books are clean, consistent, and compliant.

CRA Bookkeeping Rules For You To Follow:

- Keep records for 6+ years

- Separate personal and business expenses

- Accurate GST/HST tracking

- Report and remit source deductions

- Maintain proof of all income and claims

CRA reference: Keeping Records – CRA

Risks of Non-Compliance of CRA Rules:

- Late filing penalties

- Interest charges

- Denied tax deductions

- CRA audits and reassessments

How We Keep You Compliant:

- Built-in filing deadlines and reminders

- CRA-compliant software and reconciliations

- Hands-on support from experienced CPAs

Why Scarborough Small Businesses and Professionals Choose MAQ CPA Online Bookkeepers

✅ Licensed CPAs with Ontario-based experience

✅ Personalized, industry-specific support

✅ Deep knowledge of CRA, WSIB, and LSO rules

✅ Cloud-based bookkeeping—secure, paperless, and efficient

✅ Transparent, fixed monthly pricing

✅ Trusted by incorporated professionals and local trades alike

✅ Year Round Services

FAQs – Scarborough Bookkeeping and Accounting

1. Do you offer virtual services in Scarborough?

Yes—we serve clients virtually and offer in-person meetings on request.

2. How long does onboarding take?

We typically complete onboarding in 2–4 weeks, including software setup.

3. What is the cost of monthly bookkeeping?

Cost depends on transaction volume and services needed.

4. Can you clean up messy or overdue books?

Yes—our catch-up bookkeeping services bring your records current and audit-ready.

5. Do you offer year-end T2 corporate tax filing as well?

Absolutely—our Scarborough bookkeeping services flow directly into our year-end accounting and corporate tax filing packages.

Take the Stress Out of Your Books—Let our Scarborough Bookkeepers Help You Focus on Your Business

You’ve built your business with hard work—don’t let weak bookkeeping hold it back. At MAQ CPA, our Scarborough Cloud Bookkeepers give Scarborough business owners and professionals the clarity, accuracy, and compliance they need to grow with confidence.

Our Scarborough small business bookkeepers understand the industries that power Scarborough, and we tailor our service to your needs—no cookie-cutter solutions here.

Let’s Chat – Consultation with a Scarborough CPA

Book a consultation today. Let’s take control of your numbers and give you the peace of mind you deserve—right here in Scarborough.

📞 Call us: 416-901-4126

📧 Email us: info@maqcpa.ca