Getting “employee vs contractor” wrong is costly: payroll reassessments, penalties, and reputational fallout. The Canada Revenue Agency (CRA) uses a two-step, common-law approach—first, what the parties intended, and second, whether the facts reflect that intent using factors such as control, tools, substitution, financial risk, investment/management, and opportunity for profit. Labels don’t win—facts do. Government of Canada

If you’re unsure, either party can request a CPP/EI ruling—generally by June 29 of the year after the work year. (e.g., services performed in 2024 → request by June 29, 2025). Government of Canada

In Ontario, the Employment Standards Act (ESA) prohibits misclassification, the WSIB applies its own worker vs. independent-operator tests for workplace coverage, and the province levies Employer Health Tax (EHT) above thresholds. Ontario+1wsib.ca

Key Takeaways

- CRA applies a facts-over-intends test using six factors.

- When in doubt, request a CPP/EI ruling by June 29 of the following year.

- Employees: deduct/remit CPP, EI, income tax and issue T4; contractors: pay gross and issue T4A as required. Government of Canada

- GST/HST: contractors may need to register/charge after the $30,000 small-supplier threshold. Government of Canada

- Ontario: ESA misclassification bans; WSIB status tests; EHT exemption rules (generally first $1,000,000 of Ontario payroll 2020–2028).

How CRA decides status (Canada) and what’s unique in Ontario

Canada (outside Québec)

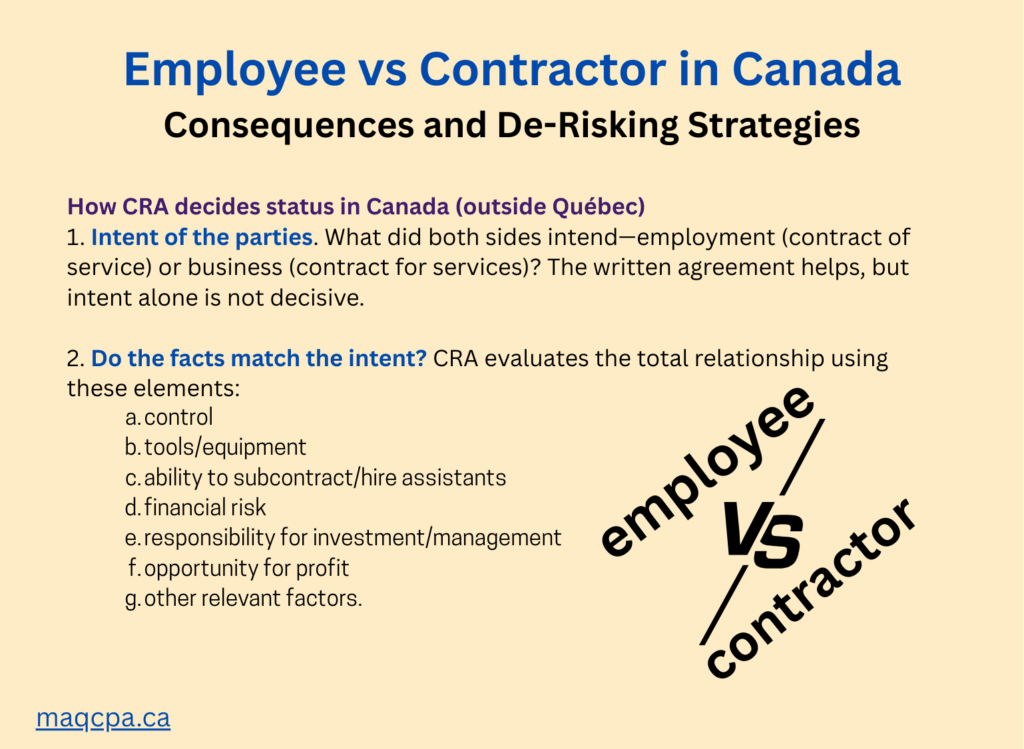

- Intent of the parties. What did both sides intend—employment (contract of service) or business (contract for services)? The written agreement helps, but intent alone is not decisive. Canada Government

- Do the facts match the intent? CRA evaluates the total relationship using these elements: control; tools/equipment; ability to subcontract/hire assistants; financial risk; responsibility for investment/management; opportunity for profit; other relevant factors. Canada Government

In Ontario:

- ESA: employers cannot misclassify employees as contractors. Ontario

- WSIB: separate worker vs independent operator status for coverage/premiums. wsib.ca

- EHT: small employers generally exempt on the first $1,000,000 of Ontario payroll (2020–2028). Ontario

Why this matters

- Misclassification risk: unexpected CPP/EI, income tax withholdings, penalties, and retroactive remittances if CRA reclassifies contractors as employees. (T4 vs. T4A exposure.) Canada Government

- GST/HST impact: genuine contractors may need to register/charge GST/HST once $30,000 in taxable supplies is exceeded in a single quarter or over four consecutive quarters. Canada Government

- PSB watch-out: if a subcontractor works via their own corporation, but would reasonably be your employee “but for” that corporation, personal services business (PSB) rules can trigger punitive tax and limit deductions. Canada Government

Business Sector-wise Tables with Determining Factors for Employee vs Subcontractors

Tip: If most indicators in the Employee column apply to your situation, route to payroll/T4. If most indicators in Contractor apply, route to T4A/GST-HST (once past $30k) and keep evidence that the facts match the paper. These are not a conclusive list of criteria, rather they are indicative how you can determine based on your specific business condition. Government of Canada

Dance & Performing Arts (studios, recitals, accompanists)

Reporting & consequences (dance):

Employees → T4 + CPP/EI/tax withholdings.

Contractors → T4A (where required) and GST/HST once over $30,000 in taxable supplies; register within 29 days of the effective date and begin charging on the sale that made you exceed the threshold.

Misclassification can trigger 10%/20% failure-to-deduct and late-remit 3%–10% (+20% if repeated knowingly) penalties plus interest;

ESA misclassification is prohibited.

Yoga / Pilates / Barre / Spin

Reporting & consequences (yoga etc.):

T4 vs T4A; GST/HST rule at $30k; consider CPP/EI ruling by June 29 if mixed.

CrossFit / Functional Fitness / Specialty Clinics

Reporting & consequences (functional fitness):

Payroll/T4 if employee;

T4A for clinic fees;

PSB exposure if the coach invoices via a corporation but the facts mirror employment.

Martial Arts Dojos (karate/taekwondo/MMA/boxing)

| Factor | Employee | Contractor |

| Control | Head coach supervising others, fixed curriculum/testing; uniform standards. | Guest seminar leaders with self-defined content/tour schedule. |

| Tools & workspace | Dojo space/equipment/insurance umbrella. | Brings own equipment/insurance; rents mats. |

| Substitution | Personal performance is expected. | Can appoint a qualified Sensei substitute. |

| Financial risk | Salary/hourly; paid regardless of class size. | Attendance-linked fees/workshop splits. |

| Investment/management | Limited. | Brand, assistants, event costs. |

| Profit opportunity | Limited. | Clinics/privates/camps across cities. |

Reporting & consequences (martial arts):

T4 for employees;

T4A for external seminars;

GST/HST after $30k;

use CPP/EI ruling for grey roles.

Aquatics & Swim Schools

| Factor | Employee | Contractor |

| Control | Safety-critical supervision, standard lesson plans, lifeguard oversight. | Private-lesson pros renting lanes with outcome deliverables. |

| Tools & workspace | Pool, safety gear, scheduling platform. | Own insurance; lane-rental model. |

| Substitution | Personal performance is common. | May arrange qualified alternatives. |

| Financial risk | Paid shifts regardless of fills. | No-show/cancellation risk; variable revenue. |

| Investment/management | Minimal. | Brand, waivers, scheduling/payments. |

| Profit opportunity | Fixed shift rates. | Packages/clinics/privates. |

Reporting & consequences (aquatics): Safety roles often employees; WSIB status may differ from CRA. ESA misclassification prohibited; CRA payroll penalties if wrong. wsib.caOntarioGovernment of Canada

Climbing / Gymnastics / Cheer

| Factor | Employee | Contractor |

| Control | Standardized progressions, safety supervision, set schedules. | Visiting coaches for clinics with outcome scope. |

| Tools & workspace | Facility equipment & systems. | Own insurance/tools for clinics. |

| Substitution | Personal service is typical. | Brings assistant/qualified sub. |

| Financial risk | Hourly/seasonal salary. | Variable clinic revenue share. |

| Investment/management | Limited. | Marketing & travel spend. |

| Profit opportunity | Limited. | Workshops across multiple clubs. |

Reporting & consequences (climb/gym/cheer):

WSIB may require worker vs independent operator status determination separate from CRA;

T4 vs T4A;

Health Clinics (physio/chiro/RMT/optometry)

Reporting & consequences (clinics):

If incorporated soloists invoice you, screen for PSB (no SBD, +5% federal PSB tax, limited deductions).

ESA misclassification exposure in Ontario.

Dental & Medical Practices (associate dentists, locums, MOAs)

| Factor | Employee | Contractor |

| Control | Practice sets hours/fee guides/assistants and workflow. | Locums/associates select methods within standards; multi-site. |

| Tools & workspace | Operatories/equipment/EMR/staff. | Own instruments/insurance; portable gear for outreach. |

| Substitution | Personal service; practice pre-approves coverage. | Locum arrangements (licensed) permitted. |

| Financial risk | Salary/draw; guaranteed minimums. | Fee-split; schedule risk. |

| Investment/management | Minimal. | Brand/CPD/equipment purchases. |

| Profit opportunity | Limited beyond comp. | Case mix, extended services. |

Reporting & consequences (dental/medical):

Same CRA payroll rules; T4/T4A as applicable;

PSB if incorporated “but for” corporation would be employment.

Tutoring & Education (music schools, test prep, camps)

| Factor | Employee | Contractor |

| Control | School mandates curriculum, lesson plans, schedule, report cards. | Instructor provides own curriculum; flexible timetable across schools. |

| Tools & workspace | Classrooms/instruments/LMS. | Own studio/instruments/software; remote setup. |

| Substitution | Personal delivery required. | Can appoint vetted substitute/assistant. |

| Financial risk | Paid per period regardless of enrolment. | Tuition-linked revenue; cancellations matter. |

| Investment/management | Low. | Brand, marketing, software subscriptions. |

| Profit opportunity | Limited. | Group classes/packs/licensing. |

Reporting & consequences (education):

T4 vs T4A; GST/HST once over $30k;

ESA misclassification in Ontario is prohibited.

Film, Creative & Media (photography, video, design, post)

| Factor | Employee | Contractor |

| Control | Agency dictates hours/tools/workflow; approvals chained. | Project scope with creative control over methods/talent. |

| Tools & workspace | Employer equipment, studio, software. | Own camera/rigs/edit suite/insurance. |

| Substitution | Must deliver personally. | May subcontract 2nd shooters/editors. |

| Financial risk | Salary/day-rate regardless of client demand. | Fixed-fee with reshoot/overrun risk. |

| Investment/management | Low. | Gear financing, assistants, marketing. |

| Profit opportunity | Limited. | Retainers, licensing/royalties, scale. |

Reporting & consequences (creative):

T4 vs T4A; GST/HST after $30k;

PSB screen for incorporated freelancers.

IT & Software / Independent Consultants

| Factor | Employee | Contractor |

| Control | Employer sets sprint cadence, code standards, hours, and mandatory meetings. | Outcome-based SOW; sets methods/tools/hours. |

| Tools & workspace | Corporate laptop/VPN/cloud. | Own stack/dev tools; cloud subscriptions. |

| Substitution | Personal delivery. | Can substitute team members (subject to security). |

| Financial risk | Salary; paid if project stalls. | Fixed-fee/scope risk; bench time risk. |

| Investment/management | Low. | Software licenses, subcontractors, PM. |

| Profit opportunity | Limited. | Multi-client retainers, pricing leverage. |

Reporting & consequences (IT/consulting):

PSB check if incorporated;

T4 vs T4A;

GST/HST registration once over $30k.

Home Services (cleaning, landscaping, snow, handyman)

| Factor | Employee | Contractor |

| Control | Company dispatches routes, sets methods, uniforms, quality checks. | Fixed-price jobs; contractor selects methods, timing, and crew. |

| Tools & workspace | Company truck/tools/fuel/PPE. | Own vehicles/equipment/insurance; invoices consumables. |

| Substitution | Must attend personally. | Can hire helpers; substitution baked into quotes. |

| Financial risk | Hourly/shift; paid for call-backs. | Bid/overrun risk; weather & demand swings. |

| Investment/management | Low. | Gear financing, payroll for helpers. |

| Profit opportunity | Limited. | Margin on bids; route density. |

Reporting & consequences (home services):

WSIB status may be triggered (construction-adjacent);

T4/T4A;

Construction & Trades (GCs, subs)

| Factor | Employee | Contractor |

| Control | Foreman dictates hours/methods; integrated crew. | Scope-of-work deliverables; limited oversight. |

| Tools & workspace | Company tools, trucks, PPE. | Own tools/trucks; invoices materials. |

| Substitution | Personal attendance required. | Free to subcontract. |

| Financial risk | Hourly; paid for rework. | Fixed-price/overrun risk; warranty exposure. |

| Investment/management | Low. | Crew management, equipment financing. |

| Profit opportunity | Limited. | Margin on bids + utilization. |

Reporting & consequences (trades):

WSIB runs its own worker/independent-operator test and status questionnaires;

CRA payroll penalties apply if misclassified.

Retail & eCommerce

| Factor | Employee | Contractor |

| Control | Store shifts/SOPs/merchandising rules. | Pop-up hosts, fractional ops on outcomes. |

| Tools & workspace | Employer POS/inventory/space. | Own platform/gear for projects. |

| Substitution | Personal shift work. | Can staff pop-ups with crew. |

| Financial risk | Hourly wages. | Performance-linked fees; ad-spend risk. |

| Investment/management | Minimal. | Ads, shop builds, tech stack. |

| Profit opportunity | Limited. | Pricing & scale leverage. |

Reporting & consequences (retail/eComm):

ESA misclassification remedies;

GST/HST after $30k for true contractors;

Hospitality & Food (restaurants, catering, events)

| Factor | Employee | Contractor |

| Control | Line protocols, recipes, uniform, shift roster. | Guest-chef/caterer sets menu/outcomes. |

| Tools & workspace | Kitchen gear/POS provided. | Own catering rig/equipment/insurance. |

| Substitution | Assigned shifts. | May bring crew. |

| Financial risk | Wage/tips. | Food cost/attendance risk. |

| Investment/management | Low. | Gear, logistics, insurance. |

| Profit opportunity | Limited. | Event margins/upsells. |

Reporting & consequences (hospitality):

Payroll/T4 vs T4A for external caterers;

GST/HST registration past $30k;

ESA misclassification risk.

Transportation & Delivery (owner-operators)

| Factor | Employee | Contractor |

| Control | Fixed routes, dispatch rules, exclusivity. | Sets routes/schedule per contract. |

| Tools & workspace | Company vehicle/fuel/cards. | Own vehicle/maintenance/insurance. |

| Substitution | Drive personally. | Relief driver permitted. |

| Financial risk | Paid per shift/route. | Fuel/repairs/idle time risk. |

| Investment/management | Minimal. | Vehicle financing; admin. |

| Profit opportunity | Limited. | Multiple contracts; scale. |

Reporting & consequences (transport):

WSIB transportation industry status framework;

CRA payroll rules;

GST/HST threshold.

Real Estate Teams & Brokerages (agents, PREC)

| Factor | Employee | Contractor |

| Control | Team dictates hours/methods/office time. | Agent controls prospecting & schedule. |

| Tools & workspace | Brokerage systems/leads provided. | Own CRM/ads; multiple channels. |

| Substitution | Must personally perform. | May engage a licensed assistant. |

| Financial risk | Stipend/wage. | Commission variance; ad-spend risk. |

| Investment/management | Minimal. | Marketing, assistants, software. |

| Profit opportunity | Limited. | Team splits; scaling. |

Reporting & consequences (real estate):

Watch PSB for incorporated agents if facts resemble employment;

T4A reporting of service fees may apply.

Authority-wise Consequences & De-Risking Strategies

| Authority | What they enforce | Key consequences if wrong | De-Risking Strategies | Attention flags |

| CRA – Payroll (CPP/EI/Tax) & Info Slips | Employee vs contractor for withholding & slips | Failure-to-deduct: 10%, or 20% if repeated knowingly; Failure-to-remit (late): 3–10% (+20% on repeat knowing), plus daily interest. T4/T4A filing obligations. Directors can be personally liable under ITA s.227.1. | Rapid reclassification; compute arrears; CPP/EI ruling file; taxpayer-relief package; automate remitter cadence; T4/T4A QA. | High risk in multi-instructor studios, clinics, trades, transport (many roles drift). Government of Canada |

| CRA – GST/HST | Small-supplier rule & registration | Must register & start charging on the sale that puts you over $30k; register within 29 days. | Threshold watch; BN/GST program setup; return cadence; ITC coaching. | Creatives/IT/consultants often cross threshold quickly. Government of Canada |

| CRA – PSB | Incorporated individuals who look like employees | No SBD, full rates, +5% PSB tax, limited deductions. | PSB screen; restructure contracts/ops; payroll vs dividends planning. | Consultants, coaches, associates invoicing via corp. Government of Canada |

| Ontario – ESA (Ministry of Labour) | Misclassification prohibited | Orders for back pay, AMPs, prosecutions. | Status audit; convert to payroll; back-pay calculations; policy fixes. | All sectors using “contractors” for shift-like roles. Ontario |

| Ontario – WSIB | Worker vs independent operator for coverage | Mandatory registration & premiums if “worker”; status questionnaires; enforcement. | WSIB status mapping; obtain decisions; integrate premiums. | Construction, transport, retail service contractors. wsib.ca |

| Ontario – EHT | Payroll tax on Ontario remuneration | General exemption $1,000,000 (2020–2028); associated-group rules; ineligible if payroll > $5M. | EHT forecasting; exemption allocation; filings. | Multi-entity groups; rapid headcount growth. OntarioDLA Piper |

FAQs – Employee vs Subcontractor

1. What six factors does the CRA use to decide employee vs contractor?

CRA examines control, tools, substitution, financial risk, investment/management, and opportunity for profit—plus overall intent vs facts.

2. When is the deadline to request a CPP/EI ruling if we’re unsure?

Generally June 29 of the year after the work year (e.g., 2024 work → June 29, 2025). Government of Canada

3. If CRA decides our “contractor” is an employee, what happens?

CRA can assess both shares of CPP/EI, 10%/20% failure-to-deduct penalties, 3–10% late-remit penalties (+20% if repeated knowingly), and interest. Government of Canada

4. What slips do we issue—T4 or T4A?

Employees → T4; payments to many contractors are reported on T4A (T5018 for construction contractors). Government of Canada

5. Do contractors have to charge GST/HST?

Yes, once they exceed $30,000 in taxable supplies in one quarter or the last four consecutive quarters; they must start charging on the sale that exceeds the threshold and register within 29 days. Government of Canada

6. Does paying a person’s corporation protect us from reclassification?

No. If the facts point to employment, their corporation may be a Personal Services Business (PSB) with harsher tax. Government of Canada

7. How is Ontario different from the rest of Canada on classification?

ESA expressly bans misclassification; WSIB runs an independent status test for coverage; EHT is a provincial payroll tax with a $1M exemption through 2028. Ontario+1wsib.ca

8. Are directors personally liable if payroll isn’t remitted?

Yes, directors can be personally liable for unremitted source deductions under ITA s.227.1, subject to due-diligence and a two-year limitation after ceasing to be a director. Justice Laws Website

9. If we voluntarily corrected last year’s errors, can penalties be reduced?

Possibly. CRA may grant taxpayer relief to cancel/waive penalties/interest in limited circumstances. Government of Canada

10. Do WSIB and CRA always agree on status?

Not necessarily. WSIB applies its own criteria for coverage; you may be an “independent operator” for WSIB and still be treated as an employee or contractor differently for CRA. wsib.ca

11. What should go into our evidence file for contractors?

Invoices, proof of multiple clients, independent marketing/brand, insurance, substitution logs, outcome-based SOW—so facts match the paper. Government of Canada

How a CPA Accountant can help you mitigate the Risks

When classifications drift, audits get expensive—fast.

- Extensive review against the six CRA factors with sector-specific checklists, then a clear T4 vs T4A routing map.

- CPP/EI ruling prep and filing for grey roles—before the June 29 deadline.

- Payroll automation: remitter cadence, source deductions, T4/T4A, ROEs.

- GST/HST watch + registration timing so you start charging at $30k on time.

- Ontario WSIB/EHT: WSIB status decisions, EHT optimization, ESA misclassification clean-up.

- Director-liability shield: due-diligence protocols.

Book a Consultation with MAQ CPA

to see how our Toronto Accountants can help you classify between employee vs subcontractor, and map your T4/T4A/GST-HST/WSIB/EHT flows. Your compliance—and peace of mind—matter.

Disclaimer

The information provided in this blog is for general informational purposes only and does not constitute professional accounting, tax, financial, or legal advice. While we strive to ensure the accuracy and timeliness of the content, the information may not apply to your specific situation or reflect the most current legislative changes. Readers are strongly advised to consult a qualified professional before making any decisions based on the content of this blog. MAQ CPA and its representatives disclaim any liability for any loss or damage incurred as a result of reliance on any information provided herein.