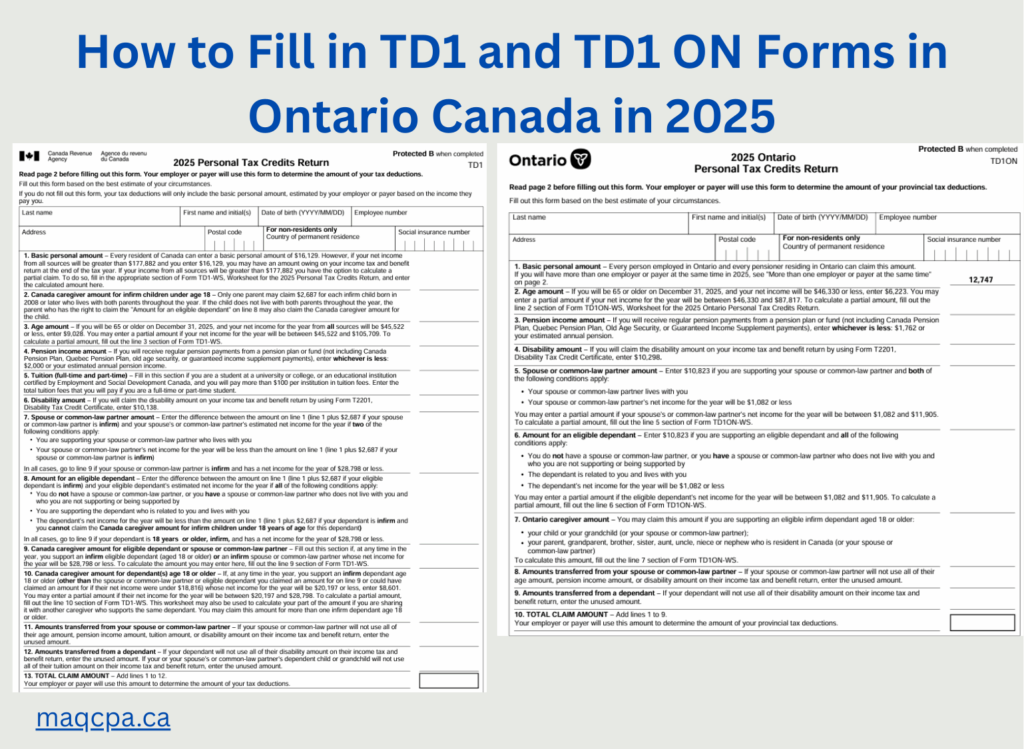

Whether you’re starting a new job, taking a second job, or your family situation has changed, you’ll be asked to complete TD1 (federal) and TD1ON (Ontario) forms. These Personal Tax Credits Returns tell your employer how much income tax to withhold from your pay. Fill them incorrectly and you could face unexpected balances due at tax time—or over-withhold and choke your cash flow. This guide, how to fill in TD1 and TD1 ON forms, walks you through every line that matters, shows realistic examples, and highlights Ontario-specific points for employees and small-business employers across Canada.

Who Must Fill TD1 and TD1ON (and When)

- New job or payer: Complete TD1 and your provincial TD1 (TD1ON for Ontario) when you start.

- Change in personal credits: New spouse/common-law status, new eligible dependant, disability tax credit approval, etc.

- More than one employer at the same time: You generally claim credits on only one TD1; the other should show $0 so you don’t under-withhold.

- Want more or less tax withheld: Ask for additional tax on the federal TD1, or request a reduction with a T1213 letter of authority (e.g., large RRSP contributions deducted at source).

Before You Start (What to Gather)

- Your SIN, full legal name, address, and date of birth.

- Spouse/common-law status and their estimated net income for the year (if you plan to claim spousal amounts).

- Eligible dependent details and their estimated net income.

- Disability Tax Credit approval (T2201), if applicable.

- Tuition estimates (if you’ll pay more than $100 to a recognized institution).

- If you’re non-resident, know whether ≥90% of your world income will be taxable in Canada this year.

Federal TD1 (2025) — Line-by-Line

The TD1 total is your federal claim amount. Your employer uses it to set federal tax withholdings.

- Line 1 — Basic personal amount: Enter $16,129 for 2025 (most employees do). If your net income will exceed $177,882, consider a partial claim using TD1-WS to avoid owing at year-end.

- Line 2 — Canada caregiver (infirm children <18): Enter $2,687 per infirm child if eligible (see form conditions).

- Line 3 — Age amount: If you’ll be 65+ on Dec 31, 2025 and net income ≤ $45,522, enter $9,028. Use TD1-WS for partial claims when income is $45,522–$105,709.

- Line 4 — Pension income amount: Enter the lesser of $2,000 or your eligible annual pension (excludes CPP/QPP, OAS, GIS).

- Line 5 — Tuition: If you’ll pay > $100 per institution, enter your estimated tuition for 2025.

- Line 6 — Disability amount: If approved via T2201, enter $10,138.

- Line 7 — Spouse/common-law partner amount: If supporting a spouse who lives with you and whose net income < Line 1, enter Line 1 minus spouse’s net income (add $2,687 to Line 1 first if your spouse is infirm).

- Line 8 — Eligible dependant amount: If you do not have a spouse/common-law partner and you support a related dependant who lives with you with net income < Line 1, enter Line 1 minus dependant’s net income (add $2,687 if the dependant is infirm and you can’t claim the under-18 caregiver on Line 2).

- Line 9 — Caregiver for eligible dependant or spouse (18+ infirm): Use TD1-WS to compute an amount if the infirm person’s net income ≤ $28,798.

- Line 10 — Caregiver for other infirm dependants (18+): Enter $8,601 (or partial via TD1-WS) if each dependant’s net income ≤ $20,197; shareable between caregivers.

- Line 11 — Transfers from spouse/common-law: Unused age, pension, tuition, disability from your spouse.

- Line 12 — Transfers from a dependant: Unused disability from a dependant and, for a child/grandchild, unused tuition.

- Line 13 — TOTAL CLAIM AMOUNT: Add Lines 1–12. Your employer uses this total to set federal withholding.

Other key checkboxes on page 2:

- More than one employer at the same time: If you already claimed credits elsewhere, check the box and put “0” on Line 13 here.

- Total income < total claim amount: Check this to stop tax withholding if your combined income will be lower than your claim total.

- Non-resident 90% rule: If <90% of your world income is taxable in Canada, you generally cannot claim personal credits—enter “0” on Line 13.

Ontario TD1ON (2025) — Line-by-Line

The TD1ON total is your provincial claim amount used to calculate Ontario tax withholding.

- Line 1 — Basic personal amount: $12,747 for 2025.

- Line 2 — Age amount (65+): If net income ≤ $46,330, enter $6,223. Use TD1ON-WS for partial amounts when income is $46,330–$87,817.

- Line 3 — Pension income amount: $1,762 or your eligible annual pension, whichever is less.

- Line 4 — Disability amount: $10,298 if approved for the Disability Tax Credit (T2201).

- Line 5 — Spouse/common-law partner amount: $10,823 if spouse’s net income ≤ $1,082. Use TD1ON-WS to compute a partial amount when spouse’s income is $1,082–$11,905.

- Line 6 — Eligible dependant: $10,823 if dependant’s net income ≤ $1,082. Use TD1ON-WS to compute partials for $1,082–$11,905.

- Line 7 — Ontario caregiver amount (18+ infirm dependants): Calculate via TD1ON-WS (includes eligible relatives like parents or children).

- Line 8 — Transfers from spouse/common-law: Unused age, pension, disability amounts from spouse.

- Line 9 — Transfers from a dependant: Unused disability from a dependant.

- Line 10 — TOTAL CLAIM AMOUNT: Add Lines 1–9 for your Ontario total.

Other page-2 options:

- More than one employer at the same time: If you already claimed ON credits on another TD1ON, check the box and put “0” on Line 10 here.

- Total income < total claim amount: Check to stop Ontario withholding if your income truly falls below the total credits.

Worked Examples (So You Can See the Numbers)

Example A — Single employee, one job, Toronto

- Facts: New full-time role; no spouse; no dependants; no DTC; not a student; resident all year.

- Federal TD1 (2025): Line 1 = $16,129; Lines 2–12 = $0 → Line 13 total: $16,129.

- Ontario TD1ON (2025): Line 1 = $12,747; Lines 2–9 = $0 → Line 10 total: $12,747.

- Result: Employer withholds based on standard federal + Ontario basic amounts.

Example B — Married, supporting spouse with income of $8,000; one job, Mississauga

- Facts: Spouse lives with taxpayer; not infirm; no dependants; no tuition/DTC; net income for spouse $8,000.

- Federal TD1 (2025):

- Line 1 = $16,129

- Line 7 (spouse): Line 1 − spouse income = $16,129 − $8,000 = $8,129

- All others = $0 → Line 13 total: $24,258

- Line 1 = $16,129

- Ontario TD1ON (2025):

- Line 1 = $12,747

- Line 5 (spouse partial): Base $10,823, reduced for spouse income between $1,082–$11,905. Using TD1ON-WS, the partial amount works out to $3,905 in this scenario.

- All others = $0 → Line 10 total: $16,652

- Line 1 = $12,747

- Result: Lower withholding than Example A due to spousal amounts (federal + partial Ontario).

Example C — Two concurrent jobs (Toronto + weekend shift in Vaughan)

- Facts: You already claimed credits at your main job.

- Federal TD1 (2025) for second job: On page 2, check “More than one employer…” and enter “0” on Line 13.

- Ontario TD1ON (2025) for second job: On page 2, check the same box and enter “0” on Line 10.

- Result: The second employer withholds more tax (no credits claimed), which prevents under-withholding across your two paycheques.

Common Mistakes to Avoid

- Double-claiming credits while working two jobs at once.

- Claiming the spousal or eligible dependent amount when the person’s net income is too high for that line.

- Forgetting to update TD1/TD1ON after life changes (marriage, separation, new dependant, DTC approval).

- Non-residents claiming credits without meeting the 90% world-income in Canada rule.

- Reducing withholding without a T1213 letter of authority when required.

Small-Business Employer Checklist

- Collect TD1 + TD1ON on day one (or via HR portal).

- If an employee has two jobs, confirm whether they’re claiming credits here or elsewhere.

- Store signed forms with payroll files; update when employees submit revisions.

- If employees request reduced withholding, file T1213 first and keep the CRA letter of authority on record.

- Use payroll systems (QuickBooks Payroll, Wagepoint, ADP) to calculate withholdings based on the totals from Line 13 (TD1) and Line 10 (TD1ON).

Summary Table — TD1 & TD1ON at a Glance (2025)

| # | What You’re Entering | Federal TD1 (2025) | Ontario TD1ON (2025) | Pro Tip / Example |

| 1 | Basic personal amount | $16,129 | $12,747 | Most employees claim these by default. |

| 2 | Age amount | $9,028 if 65+ and income ≤ $45,522 (partial to $105,709) | $6,223 if 65+ and income ≤ $46,330 (partial to $87,817) | Use TD1-WS or TD1ON-WS for partials. |

| 3 | Spouse/common-law | Line 1 − spouse income (add $2,687 if spouse is infirm) | $10,823 if spouse income ≤ $1,082; partial to $11,905 via worksheet | Example B shows real numbers. |

| 4 | Eligible dependant | Line 1 − dependant income (add $2,687 if infirm & under 18 rules don’t apply) | $10,823 if dependant income ≤ $1,082; partial to $11,905 | Only one of spouse or eligible dependant can be claimed. |

| 5 | Disability amount | $10,138 (with T2201 approved) | $10,298 (with T2201 approved) | Attach DTC proof to your records. |

| 6 | Caregiver amounts | Multiple lines; some require worksheet calcs | Ontario caregiver on Line 7 via TD1ON-WS | Keep evidence of infirm status & income. |

| 7 | Tuition | Actual tuition (> $100 per institution) | N/A on TD1ON | Keep receipts; coordinate with transfers. |

| 8 | Transfers | From spouse/dependant (unused credits) | From spouse/dependant (unused credits) | Track who is using which credit. |

| 9 | Totals | Line 13 (federal) | Line 10 (Ontario) | Employers use these totals for withholdings. |

| 10 | Two employers? | Check the box; enter 0 on Line 13 at second job | Check the box; enter 0 on Line 10 at second job | Prevents double-claiming credits. |

FAQs – How To Fill In TD1 and TD1ON in Ontario Canada

1) Do I submit TD1 and TD1ON to the CRA?

No—give them to your employer (or HR portal). You keep copies for your records. The CRA only needs them if requested.

2) I work two jobs. Can I claim the basic amounts twice?

No. Claim your credits on one TD1/TD1ON only. On the other employer’s forms, check “More than one employer…” and enter “0” on the totals.

3) Can I stop tax being withheld entirely?

If you’re sure your total annual income will be less than your total claim amount, you can check the “Total income is less than…” box (federal and Ontario). If you’re wrong, you might owe at tax time.

4) My spouse earns some income—can I still claim the spousal amount?

Yes, often partially. For federal TD1, it’s Line 1 minus spouse net income (add the infirm top-up if applicable). For Ontario, the full $10,823 applies only if spouse income is ≤ $1,082; otherwise compute a partial on TD1ON-WS up to $11,905.

5) I’m a non-resident working in Ontario—can I claim these credits?

Only if ≥90% of your world income is taxable in Canada for the year. Otherwise, enter 0 and don’t claim credits.

6) How do I get less tax taken off for big RRSP contributions?

Ask CRA for a T1213 letter of authority to reduce source deductions. Give the letter to your employer. (If the RRSP is deducted by payroll, a letter may not be required.)

7) When should I update my TD1/TD1ON?

Any time your credit situation changes (marriage/separation, new dependant, DTC approval) or you start another job.

8) Does tuition on TD1 reduce my paycheque taxes right away?

Yes—if you enter current-year tuition on Line 5 (TD1) your employer can reduce withholding during the year. Coordinate with any transfer to spouse/parent at tax time.

9) Why are my disability amounts different on TD1 vs TD1ON?

Federal and Ontario set different credit amounts. That’s normal; claim what each form allows if you’re eligible.

10) Is using the wrong amount a big deal?

It can be. Over-claiming risks a balance due and interest at tax time. Under-claiming hurts cash flow. If unsure, claim conservatively and adjust mid-year.

Consult a Payroll Service Provider Toronto/Scarborough

The fastest way to get your paycheques right is a clean TD1 + TD1ON—filled with accurate totals, correct spousal/dep amounts, and updated when life changes. If your forms don’t match your reality, your withholdings won’t either.

Need a hand? Contact MAQ CPA’s Accountants Toronto. We’ll compute your exact federal and Ontario claim totals, set up a second-job strategy (if needed).

Disclaimer

The information provided in this blog is for general informational purposes only and does not constitute professional accounting, tax, financial, or legal advice. While we strive to ensure the accuracy and timeliness of the content, the information may not apply to your specific situation or reflect the most current legislative changes. Readers are strongly advised to consult a qualified legal or tax professional before making any decisions based on the content of this blog. MAQ CPA and its representatives disclaim any liability for any loss or damage incurred as a result of reliance on any information provided herein.